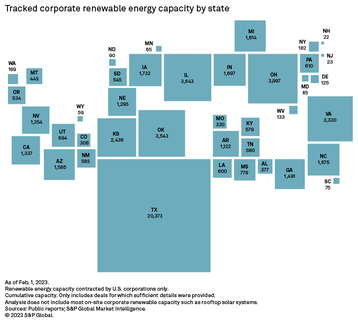

The data center industry is continuing its massive spending spree on renewable energy, with contracts for 40GW of wind and solar power in the US.

The amount of renewable power booked by data center operators increased by 50 percent in a year, and the sector now consumes two-thirds of the renewable power available to corporates in the US, according to a report from S&P Global. Contrasting the level of data center buying, S&P's report suggests that the data center sector's appetite for renewable power may affect US states' net-zero plans.

The hyperscalers Amazon, Google, Meta, and Microsoft dominate the market for renewable energy via power purchase agreements, as they have in previous years, striving to meet ambitious net-zero targets, under which most have promised to be 100 percent renewable.

The leader is Amazon, which pulled ahead of the rest in the US, with more than 20GW of wind and solar power. Google, Meta/Facebook, and Microsoft are second, third, and fourth respectively. Smaller purchasers such as Iron Mountain, Digital Realty, QTS, and Switch added up to about 1.5GW.

For the global market, the picture is similar. Adding in Apple, the big five have contracted for 45GW of corporate renewable purchases worldwide, which makes up more than half of the global corporate renewables market. Around 57 percent of the world's wind and solar power tracked by S&P is contracted to the hyperscalers.

State by state

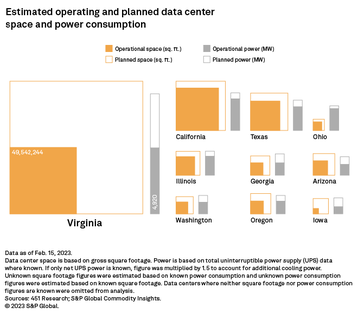

Within the US, S&P notes the continued dominance of the Northern Virginia data center hub, which alone consumes 9GW of power, with 50 million square feet of space there, and the leading players owning some 116 facilities. Utility Dominion Energy reports that data centers use about 20 percent of the power it sells in Virginia., and the total power used in the state is up 28 percent on last year

This is causing some strains. Dominion warned in July 2022 that future supplies to data centers might be in question, but the company has since said it has mitigated the issue somewhat.

In the longer term, however, the rate of data center growth could strain Virginia's future plans. Under State law, energy providers must provide 100 percent renewable energy by 2050. Virginia currently provides 3.3GW of renewable capacity, and the state has current plans for at least 4GW of new data center capacity, more than the next seven states combined.

California is the second biggest hub, with 2.3GW, but has a stronger renewable story, with the second largest renewable installed base in the US, at around 18.4GW of wind and solar, and a plan to reach 100 percent carbon-free energy by 2045. Data centers have contracted around 1.3GW of corporate renewable capacity, led by Amazon, Apple, Digital Realty, Google, and Microsoft.

Texas has 1.8GW of data centers and plans for another 500MW, mostly in Dallas/Fort Worth and San Antonio - but is a massive leader in renewable power, with 20GW contracted to corporates. There's another 62GW of solar and 11.6GW of wind in the state.

In the Southeast, Georgia has 679MW of planned data centers, while Tennessee and Alabama are adding another 369MW. Iowa has 666MW of planned data center power capacity,

Mismatch

Although the big data center players have contracted for 40GW of renewable power in the US, S&P's current estimate of their total power demand is just over 22GW, a figure expected to climb to 33GW in the next few years (although S&P warns this might be an underestimate given the current heat in the market).

Operators contract for more GW of power than they currently use for multiple reasons, but a big factor is the fact that renewable projects quote their peak capacity, while average power generation is much lower because wind and solar are intermittent - as solar and wind power aren't available when there is no wind or sunshine.

Some providers, such as Google, Microsoft, Bulk, and Iron Mountain are experimenting with hourly matching for their renewable energy needs, and there are initiatives to offer 24x7 PPAs, which use battery storage to match renewable energy purchased to the actual power used by the customers.