As the global energy landscape shifts towards an electrified future driven by renewables, aligning electricity demand with renewable supply has become increasingly critical. The rapid growth of solar photovoltaic installations is reshaping electricity generation, resulting in increased volatility in power pricing and significant challenges in maintaining grid stability, particularly on sunny days.

Homeowners with solar PV now face a complex environment where traditional energy management practices may no longer suffice. With declining feed-in tariffs, export limits, and more flexible grid fees and electricity tariffs, homeowners must adapt to the new solar environment or risk underutilizing their PV systems. In this context, Home Energy Management Systems (HEMS) are emerging as essential tools, enabling consumers to navigate grid complexities, optimize energy usage, and contribute to a more resilient and low-carbon grid.

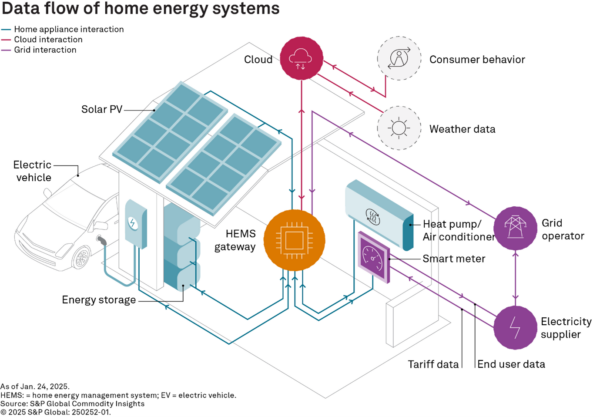

HEMS serves as the conductor of home energy optimization and grid interaction

HEMS software is designed to optimize the use of energy assets within homes, allowing consumers to maximize self-consumption and take advantage of fluctuating electricity tariffs. By coordinating resources such as solar, batteries, electric vehicles (EVs), and heat pumps, HEMS helps households navigate the complexities of modern electricity consumption. This orchestration of home assets leads to significant cost savings and unlocks new revenue streams in electricity markets.

Modern HEMS offer functionalities that enhance energy management in three key areas: interoperability, dynamic tariff response, and advanced grid interaction. They can increase the operability of home energy assets, such as adjusting hot water heating or EV charging in response to solar generation. HEMS can automatically manage energy flows in response to dynamic tariffs by shifting consumption to periods of lower costs, such as charging energy storage or EVs during the cheapest hours of the day. Furthermore, HEMS can facilitate participation in energy markets, allowing consumers to generate additional revenue through markets such as demand response programs, ancillary services, and congestion management. Collectively, these features can significantly reduce the payback periods for newly installed home energy systems.

The role of HEMS may vary across regions. In colder climates, such as the UK or the Nordics, the interaction between home loads, such as energy storage, EV charging, and heat pumps, with dynamic tariffs may be most beneficial. In warmer climates, the interaction between solar PV and air-conditioning and cooling systems may be key. However, the principle remains the same: enabling home assets to communicate with one another and interact with the grid in a cost-effective and timely manner.

Surge in connected devices creates growing market opportunity

Many HEMS offerings are currently quite basic. Simple HEMS, often provided by hardware manufacturers such as solar inverter and EV charger providers, typically interact only with simple remuneration schemes like flat feed-in tariffs and do little to adjust production or consumption to market signals. As a result, they struggle to handle complex scenarios such as negative electricity pricing or limits on solar exports. This means that even a recently installed inverter may quickly become obsolete as regulation rapidly changes. This is especially true in regions with high renewable penetration, such as the Netherlands, where grid fees and congestion are rising, feed-in tariffs are set to be dramatically cut, and negative pricing is increasingly common.

The HEMS market is currently highly fragmented and competitive, with hardware manufacturers, system integrators, energy retailers, and dedicated software providers competing for market position. Each of these HEMS providers has distinct advantages: hardware providers typically have the widest geographic footprint and the deepest understanding of hardware capabilities, software providers can work across multiple brands simultaneously, and system integrators and energy retailers have the closest customer interaction. On the other hand, each provider has its constraints. For example, software providers typically have little crossover of geographic borders, and numerous hardware manufacturers operate with minimal interaction with other home devices. As a result, partnerships will be essential to offer value to consumers, as no single supplier can manage the entire value chain, from manufacturing through integration and providing electricity tariffs, alone.

The HEMS market is still in its infancy in revenue terms; however, it is expected to grow rapidly over the coming years. The global installed capacity of distributed energy resource (DER) units, including solar inverters, energy storage, EV charging units, and heat pumps, is projected to quadruple from 144 million in 2025 to 570 million by 2035, according to S&P Global Commodity Insights. This growth will also be accompanied by a substantial rise in revenue generated per DER unit over the next 10 years, resulting in for the HEMS market by 2035. This expansion will be fueled by various revenue streams, including HEMS gateway sales, subscription services, revenue-sharing options, and the monetization of data.

Although the outlook for HEMS is promising, challenges remain before the mass adoption of advanced HEMS technologies. Regulatory discrepancies across regions, varying communications protocols, and a lack of incentives for time-shift behavior all pose significant hurdles. As cybersecurity threats increase, compliance with data protection regulations will also be essential for maintaining consumer trust and ensuring the secure operation of HEMS.

Conclusion

In conclusion, the HEMS market is poised for rapid growth, presenting significant opportunities for innovation and development. As consumers increasingly adopt distributed energy resources (DERs) and seek to optimize their energy usage, the demand for sophisticated HEMS solutions is expected to continue to rise. By enabling seamless interaction between home energy assets and the grid, HEMS not only reduces costs for consumers but also enhances overall grid stability, ensuring a more efficient and cost-effective solution for consumers and the grid.

Authors: Liam Coman and Siqi He

Liam Coman is a solar research analyst within the Clean Energy Technology research team at S&P Global Commodity Insights. He researches the global solar inverter, balance of system and energy storage inverter supply chains. He works with suppliers to analyze trends, produce market forecasts and assess the competitive landscape of the solar inverter industry. Prior to joining S&P Global, Mr. Coman worked for an engineering consultancy specializing in environmental regulation and policy compliance. He holds an M.Eng in Mechanical and Manufacturing Engineering from Trinity College Dublin.

Siqi He is a Principal analyst within the Clean Energy Technology team at S&P Global Commodity Insights and is responsible for research of the global photovoltaic (PV) inverter, energy storage inverter, and solar supply chain. Prior to joining S&P Global Commodity Insights, she worked for Wood Mackenzie Power & Renewables in New York and spent four years as a financial analyst with PetroChina in Beijing, China. Ms. He holds a bachelor’s degree in finance from Renmin University of China and a Master of Public Administration with a concentration in global energy management from Columbia University, United States. She is based in Shanghai, China.

S&P Global Commodity Insights delivers comprehensive market data, benchmarks and insights for global energy and commodities markets, powered by a global team of specialists dedicated to delivering essential market intelligence. We enable customers to make decisions with conviction and create long-term, sustainable value.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.