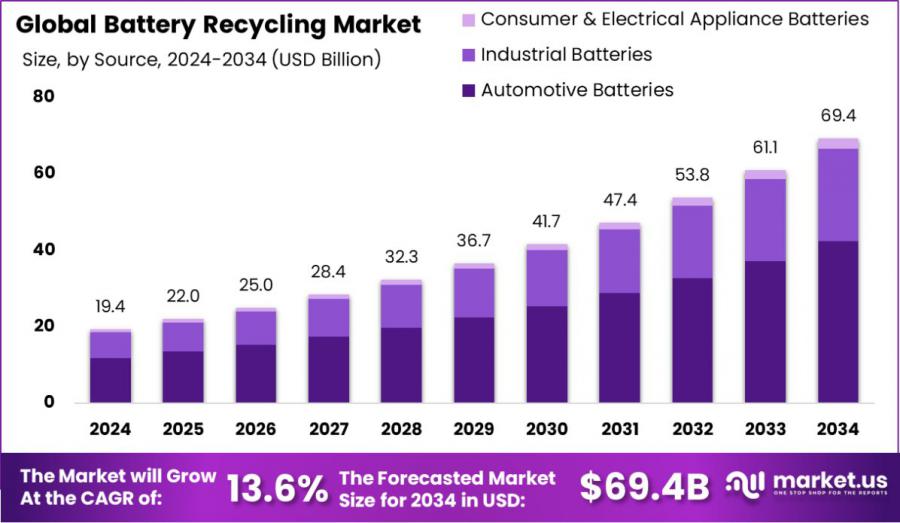

Battery Recycling Market to Reach USD 69.4 Billion by 2034, Growing at 13.6% CAGR

Battery Recycling Market size is expected to be worth around USD 69.4 bn by 2034, from USD 19.4 bn in 2024 CAGR of 13.6% during the forecast period 2025 to 2034

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- Report Overview

Battery recycling is the process of reprocessing and reusing batteries to reduce the number of batteries being disposed of as municipal solid waste. Batteries contain several heavy metals and toxic chemicals, so their disposal has environmental and health implications. Recycling them helps conserve natural resources, prevents air and water pollution stemming from landfills or improper disposal, and reduces greenhouse gas emissions. Types of commonly recycled batteries include lead-acid automotive batteries, nickel-cadmium (NiCd) batteries, nickel metal hydride (NiMH) batteries, and lithium-ion (Li-ion) batteries, among others.

The battery recycling market involves the collection, sorting, processing, and material recovery of batteries. This market is driven by the increasing adoption of electric vehicles (EVs), portable electronics, and energy storage solutions, which are heavily dependent on batteries. As battery usage increases, so does the need for effective recycling methods to manage end-of-life products and materials. The market is segmented by chemistry, source, and region, focusing on maximizing resource efficiency and minimizing the environmental impact of used batteries.

The growth of the battery recycling market is primarily fueled by stringent government regulations and initiatives aimed at reducing environmental pollution and promoting sustainability. Increased awareness among consumers and manufacturers about the benefits of battery recycling also plays a crucial role.

Additionally, advancements in recycling technologies and processes have improved recovery rates and efficiency, making recycling more feasible and economically viable. These factors collectively contribute to the growing robustness of the battery recycling industry.

Demand in the battery recycling market is driven by the surging use of batteries in various applications, including automotive, industrial, and consumer electronics. The growth in electric vehicle sales and renewable energy installations, which require large battery storage systems, has particularly spurred this demand. As batteries reach their end of life, the need to manage them responsibly and recycle valuable materials like lithium, cobalt, and nickel supports the expansion of the recycling market.

The battery recycling market presents significant opportunities for developing new recycling technologies and expanding existing capacities to handle different types of batteries. There is also a rising opportunity in the recovery of precious materials such as lithium and cobalt, which are critical for manufacturing new batteries. Exploiting these opportunities can lead to substantial economic benefits and foster a circular economy in the battery industry.

Key driving factors for the battery recycling market include the increasing depletion of precious natural resources and the high cost of raw materials used in battery manufacturing. The environmental regulations enforcing responsible disposal of hazardous waste and the economic incentives for recovering valuable materials from used batteries further propel the market's growth.

Get a Sample PDF Report: https://market.us/report/battery-recycling-market/request-sample/

Key Takeaway

• Battery Recycling Market size is expected to be worth around USD 69.4 Bn by 2034, from USD 19.4 Bn in 2024, CAGR of 13.6% during the forecast period 2025 to 2034

• In 2024, Automotive Batteries held a dominant market position, capturing more than a 61.20% share in the battery recycling market.

• In 2024, Lead-acid batteries held a dominant market position in the battery recycling sector, capturing more than a 73.10% share.

• In 2024, Pyrometallurgy held a dominant market position in the battery recycling sector, capturing more than a 56.20% share.

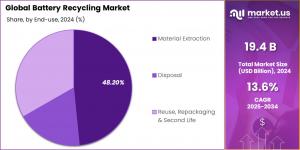

• In 2024, Material Extraction held a dominant market position in the battery recycling sector, capturing more than a 48.20% share.

• In 2024, the Asia Pacific (APAC) region dominated the battery recycling market, accounting for 39.40% of the market share and generating an estimated value of USD 7.6 billion.

Battery Recycling Market Segment Analysis

By Source Analysis

In 2024, automotive batteries dominated the battery recycling market with a 61.20% share, driven by rising EV demand and end-of-life battery disposal needs. Passenger cars led this segment, while commercial vehicles and two-wheelers contributed steadily. Industrial batteries are set to grow in 2025, while consumer electronics recycling is rising due to regulatory policies and valuable material recovery.

By Battery Chemistry Analysis

In 2024, lead-acid batteries dominated the battery recycling market with a 73.10% share, driven by widespread automotive and industrial use and near 100% recyclability. Lithium-ion batteries, especially NMC and LFP, are gaining traction, with rising EV demand boosting recycling rates. Nickel-based and emerging battery technologies hold niche shares but are expected to grow as recycling advances.

By Technology Analysis

In 2024, pyrometallurgy led the battery recycling market with a 56.20% share, valued for its efficiency in processing lead-acid and nickel-based batteries. Hydrometallurgy is gaining traction, especially for lithium-ion recycling, with expected growth in 2025. Mechanical separation plays a crucial role in pre-processing. As demand rises, technology advancements will enhance recovery efficiency and sustainability.

By End-use Analysis

In 2024, material extraction led the battery recycling market with a 48.20% share, driven by demand for lithium, cobalt, nickel, and lead recovery. Disposal remains necessary for non-recyclable components, while reuse and second-life applications are growing, particularly for stationary energy storage. As technology and regulations evolve, these segments support sustainability and the circular economy in battery recycling.

Buy Now: https://market.us/purchase-report/?report_id=57736

Key Market Segments

By Source

• Automotive Batteries

— Passenger Cars

— Light & Heavy Commercial

— Others(2 & 3 Wheelers)

• Industrial Batteries

• Consumer & Electrical Appliance Batteries

By Battery Chemistry

• Lithium-ion

— Lithium Cobalt Oxide (LCO)

— Lithium Manganese Oxide (LMO)

— Lithium Nickel Manganese Cobalt Oxide (NMC)

— Lithium Nickel Cobalt Aluminum Oxide (NCA)

— Lithium Iron Phosphate (LFP)

— Others

• Lead-acid

• Nickel based

• Flow Batteries

• Others

By Technology

• Pyrometallurgy

• Hydrometallurgy

• Mechanical Separation

By End-use

• Material Extraction

• Disposal

• Reuse, Repackaging & Second Life

Top Emerging Trends

1. Expansion of Electric Vehicle Production: The battery recycling market is witnessing significant growth due to the expanding electric vehicle (EV) industry. As global demand for EVs surges, so does the need for efficient battery disposal and recycling methods. This trend is driven by environmental concerns and the scarcity of raw materials like lithium and cobalt, which are critical for battery production. Recycling helps in recovering these valuable materials, reducing the environmental impact of mining, and ensuring a sustainable supply chain for the burgeoning EV market.

2. Advancements in Recycling Technologies: Innovative technologies are transforming battery recycling processes, making them more efficient and environmentally friendly. These advancements include improved methods for sorting, dismantling, and material recovery. For example, new mechanical and hydrometallurgical techniques are enhancing the recovery rates of precious metals from spent batteries. These technologies not only increase the economic viability of recycling operations but also minimize the environmental footprint associated with traditional recycling methods.

3. Stringent Environmental Regulations: Governments worldwide are implementing stricter regulations regarding battery disposal, which significantly influences the battery recycling market. These regulations are designed to reduce hazardous waste and encourage the recovery of valuable materials. Compliance with these rules is pushing companies to invest in battery recycling facilities and adopt greener practices, thereby propelling market growth and fostering a more sustainable battery lifecycle.

4. Growing Consumer Electronics Recycling: The rise in consumer electronics usage globally is leading to increased volumes of spent batteries. This trend is particularly pronounced in smartphones, laptops, and other portable devices that require frequent battery replacements. Recycling of these batteries is becoming more critical due to the toxic and hazardous substances they contain. As a result, there is a growing emphasis on developing more robust recycling programs and facilities to handle the waste from consumer electronics effectively.

5. Partnerships and Collaborative Initiatives: Strategic partnerships and collaborative initiatives between government bodies, recycling companies, and battery manufacturers are pivotal in driving the battery recycling market forward. These collaborations are aimed at improving recycling rates and expanding recycling infrastructure. By pooling resources and expertise, stakeholders are better equipped to address the challenges associated with battery disposal and promote circular economic models in the battery industry.

Regulations on the Battery Recycling Market

In recent years, significant regulatory developments have shaped the battery recycling market, particularly in the European Union (EU). In July 2023, the EU adopted Regulation (EU) 2023/1542, aiming to enhance the sustainability and safety of batteries throughout their lifecycle.

This regulation, effective from February 2024, introduces comprehensive measures to ensure batteries have a low carbon footprint, utilize minimal harmful substances, and are efficiently collected, reused, and recycled within the EU.

Key targets include achieving a 63% collection rate for portable batteries by the end of 2027 and 73% by the end of 2030. Additionally, the regulation sets ambitious recycling efficiency goals, such as 80% for nickel-cadmium batteries and 65% for lithium-based batteries by the end of 2025. These measures are designed to reduce environmental impact and promote a circular economy within the battery industry.

In the United States, the Environmental Protection Agency (EPA) has been proactive in addressing battery recycling challenges. In October 2023, the EPA announced plans to propose a rule that would add solar panels to current universal waste regulations and establish official standards for lithium batteries.

Regional Analysis

The Asia-Pacific region leads the global battery recycling market, accounting for approximately 39.40% of the market share, valued at USD 7.6 billion. This dominance is driven by rapid industrialization, urbanization, and the escalating adoption of electric vehicles (EVs) in countries such as China, India, Japan, and South Korea.

China, in particular, stands out as a significant contributor due to its substantial production and consumption of batteries, especially lithium-ion variants. The region's focus on sustainable practices and stringent environmental regulations further bolster the growth of the battery recycling industry.

In North America, the battery recycling market is experiencing substantial growth, propelled by the increasing demand for EVs and renewable energy storage solutions. The United States plays a pivotal role in this expansion, supported by federal policies like the Responsible Battery Recycling Act of 2022 in California, which mandates battery retailers to implement collection systems for used rechargeable batteries. Additionally, the presence of leading industry players and large-scale recycling facilities enhances the region's capacity to manage battery waste effectively.

Europe is also witnessing significant advancements in the battery recycling sector, driven by the presence of key automotive companies and stringent environmental regulations. The European Union's Battery Directive mandates specific recycling efficiency targets, encouraging the recovery of valuable materials from used batteries. This regulatory framework, coupled with the region's commitment to reducing environmental impact, is anticipated to drive demand for recycled batteries over the forecast period.

The Middle East and Africa are gradually recognizing the importance of battery recycling, with emerging initiatives aimed at managing electronic waste and promoting sustainable practices. While the market is still in its nascent stages, increasing awareness and the adoption of environmental regulations are expected to stimulate growth in the coming years.

Latin America is experiencing a growing interest in battery recycling, driven by the expansion of the automotive sector and rising environmental concerns. Countries like Brazil and Argentina are focusing on developing recycling infrastructure to manage the increasing volume of used batteries, aiming to mitigate environmental risks and recover valuable materials.

Key Players Analysis

◘ Accurec Recycling GmbH

◘ Fortum

◘ Glencore

◘ Umicore

◘ Exide Industries Ltd

◘ Gravita India Ltd

◘ Li-Cycle

◘ RecycLiCo Battery Materials

◘ Tata Chemicals Ltd.

◘ American Battery Technology Company

◘ Cirba Solutions

◘ Gopher Resource LLC

◘ East Penn Manufacturing

◘ Aqua Metals

◘ Eco-Bat Technologies

◘ Ganfeng Lithium Group Co., Ltd.

◘ Lithion Recycling Inc.

◘ EnerSys

◘ Redwood Materials, Inc.

◘ Element Resources LLC

◘ Contemporary Amperex Technology Co. Limited

◘ Stena Recycling

◘ REDUX Recycling GmbH

◘ Other Key Players

Recent Developments Battery Recycling Market

— In January 2024, Redwood Materials, Inc. ground on a new $3.5 billion battery factory in South Carolina, aiming for 100% electric operations and zero fossil fuel use.

— In October 2022, American Battery Technology Company was selected for a $57 million grant by the U.S. Department of Energy to design and operate a commercial-scale facility for manufacturing battery cathode-grade lithium hydroxide.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release